This is the third post in our series on selecting a good investment fund, where we're taking you through the process we use.

This is the third post in our series on selecting a good investment fund, where we're taking you through the process we use.

In the first post of this tutorial we discussed the market's current trend and took a look at Morningstar and an example fund, while last time we examined the importance of a fund's manager, as well as its risk profile and portfolio.

In this post well look at how charts can also help you succeed in selecting a good investment fund.

The fund's chart

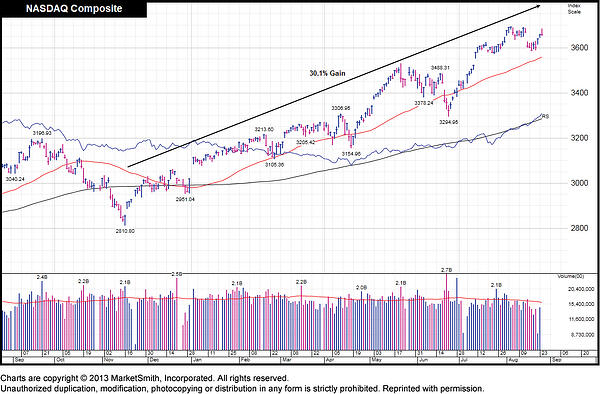

Before we take a look at our example fund's chart, lets recap what the market had done recently. If you remember, the return made over the previous nine months was 30.1%. We can use that return as a performance benchmark to measure against.

1 year view

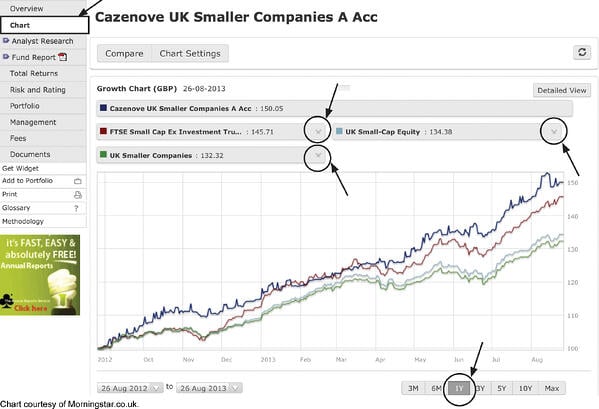

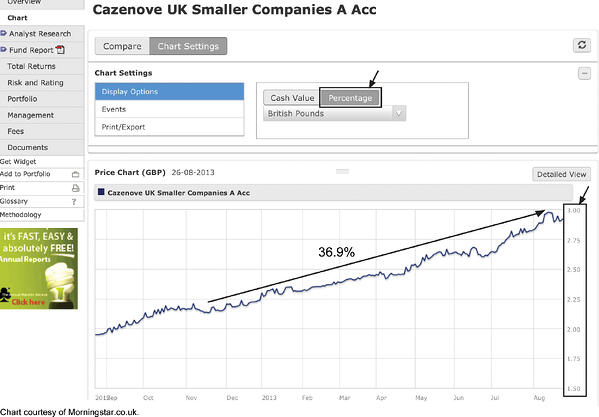

When you click on the Chart tab in the left hand column, the default chart shown is a 1 year view of the fund’s performance. To get an unobstructed view of its performance, you need to click on the three ‘X’s’ that show FTSE Small Cap Ex Investment Tru..., UK Small-Cap Equity and UK Smaller Companies.

YTD chart view

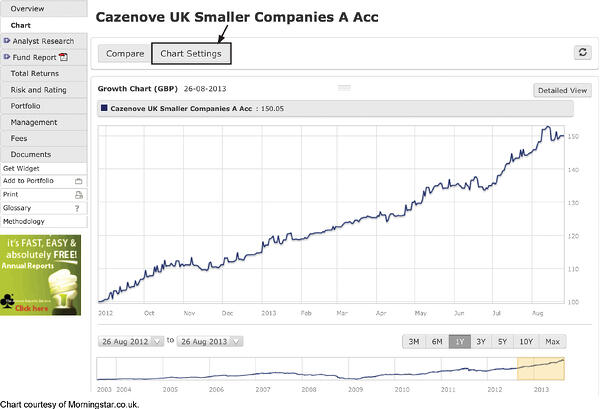

Next, click on the ‘Chart Settings’ tab.

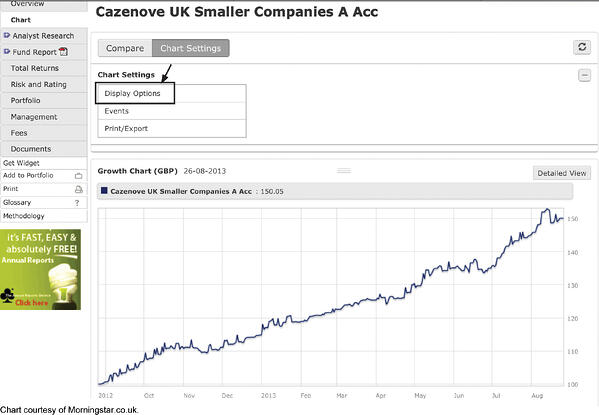

Now click on ‘Display Options’.

To view the fund's price, click on the ‘Percentage’ tab. Notice the price scale that appears on the right hand side of the chart.

Past Prices

To check how the fund has performed over any period, you simply hover your mouse pointer over the image, allowing you to see past prices of the fund. When we hovered over this one to locate November 16th 2012 (the date the NASDAQ Composite started its nine month uptrend), we found out that the fund was trading at 2.14 and on August 27th 2013, when this screenshot was taken, it was trading at 2.93, a 36.9% nine month return.

With the NASDAQ Composite making a 30.1% return over the same period, it provided evidence that this fund was outperforming the NASDAQ in the short term as well as the long term – and that’s exactly what we're looking for.

In our final post in this series we'll look at funds' fees and charges, as well as the documentation you should read before investing.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions*.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* 15th November 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

** 31st December 2008 - 31st December 2012.

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>