Please talk to your financial adviser about risk and its implications on your finances.

Please talk to your financial adviser about risk and its implications on your finances.

Following on from our recent post What is investment risk?, in this post we'll look at four other investment risks that investors need to understand.

In order to plan financially, you need to throughly understand investment risk. Many people see 'risk' as the possibility of being defrauded or losing their investment. This 'capital' risk is important, but it isn't the only type of investment risk.

Only concentrating on capital risk and ignoring these other risks can lead to investors taking an approach that's too cautious to reach their goals. Here are four other types of risk to consider when making your investment decisions.

Specific investment risk

This is the risk that the investment you've invested in performs badly. Some investments will fluctuate more than others. First time investors should be especially concerned to keep this type of risk to a minimum.

This could be done by building up less risky assets first - so if you buy share-based investments such as investment funds, they'll have less effect on your overall portfolio. You can also reduce your specific risk by investing across a range of shares. In this way, if one of them goes bust, or falls heavily, the overall effect on your portfolio is less.

The best and cheapest way to spread your risk is to invest in pooled investments like Unit Trusts or OEICs (pronounced Oiks) or Investment Trusts. They are called pooled investments because you pool your money with other savers to buy a wide range of shares.

Market risk

This is the risk of a fall in a particular country's stock market where your money is invested. When a market falls you will usually find that most funds that own those shares are dragged down with it. Some fall by more than the average, some by less, but few will buck the overall trend.

A good way of avoiding market risk is to invest your money gradually, for example through a monthly investment scheme, as this will smooth out big variations in the price.

You can reduce market risk by investing in many stock markets around the world. This works because not all stock markets will rise and fall together by the same amount, so if one crashes, you should be able to limit your losses because the others won't have fallen as much.

Currency risk

If your money is invested in stock markets outside the UK, then you will face currency risk. Wherever your money is invested, it will have to be converted into Sterling when you want it back. As a result, movements in the exchange rate will affect the value of your investment - this can work in your favour or against you.

You can limit currency risk by diversifying, for example through an international fund that spreads its investments around the globe. Alternatively, you can avoid currency risk by sticking to the UK, but this increases your market risk.

Manager risk

There is a huge variation in the investment performance of individual managers of Unit and Investment Trusts. It would be great if we could pick the winners in advance, but over the long-term very few managers manage to beat the stock market.

The key is finding those star-performing managers and this is where you may need help from experts.

Risk attitudes

Your own attitude to risk is crucial. Some people are happy to live with capital risk if it means the chance of a higher return in the end. Others are 'risk averse' and don't want to risk their capital under any circumstances.

Only you can judge what level of risk you feel comfortable with. A good Independent Financial Adviser will help you establish your attitude to risk, especially if you are not confident or experienced.

However it’s important to find an adviser that specialises in investments and to make sure that they go through this process of finding your ‘attitude to risk’ thoroughly.

You may have a different attitude for different types of investments. For example you might be happy to take some risk with money you won't need access to for many years – but if you are also saving up for something over just a few years, you'll need to be much more cautious.

Most importantly – ask yourself whether you can cope with the idea of your investment losing money. Or would you panic if the stock market dropped and take the lot out?

If the answer is yes to the last question, stock market investments are not for you – no matter how long you have to invest.

Understanding your attitude to investment risk

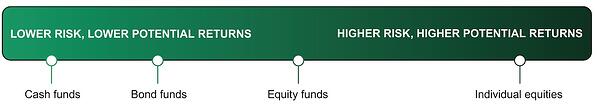

Investing in equities (shares), bonds or cash carries different levels of risk that need to be considered against potential returns. A higher level of risk normally means that the potential for growth is greater, but there is also a greater possibility that your investment might go down.

What is important is deciding the level of risk that you are comfortable with. The diagram below illustrates the risk/return spectrum. The investments towards the left carry less risk, but the potential returns are lower. Those at the other end carry more risk, but also have more chance of producing greater returns.

The risk return spectrum

There is a risk that your investments could fall in value, but over the long-term they should have time to recover from any setbacks and could go on to achieve greater levels of growth. Remember it’s not how much your account has gone up or down in the past few days, but how much it is going to be worth in 20 or 30 years time.

If you want to achieve significant levels of growth, you need to tolerate some investment risk. You may find that you can manage this risk through diversification - spreading your money across funds that invest in a variety of markets and types of investment. This will be the subject of another post very soon.

Useful links:

The importance of portfolio diversification

About ISACO

ISACO was established in 2001 by brothers Stephen and Paul Sutherland and is the first financially regulated firm to offer adventurous ISA and SIPP investors a unique personal investment service that shares on a daily basis our star-performing investor’s thoughts, personal insights and investment decisions.

Clients enjoy being informed throughout the year what ‘best of breed’ funds our premier investor currently owns, when he’s buying and when he’s moving into the safe harbour of cash – helping clients enjoy more control, manage their portfolio more effectively and benefit from the potential of outstanding long-term returns.

For more information about ISACO and our Investment Guidance Service, please read our free brochure.

If you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.