In this series of posts, we're looking at how your can draw up a retirement savings plan, with the aim of enjoying a comfortable and secure lifestyle later in life. Last time we looked at the first two steps of creating a retirement savings plan and the importance of factoring in inflation.

In this series of posts, we're looking at how your can draw up a retirement savings plan, with the aim of enjoying a comfortable and secure lifestyle later in life. Last time we looked at the first two steps of creating a retirement savings plan and the importance of factoring in inflation.

In this post we'll move onto Step 3, which is calculating the growth rate you'll need on your investments to reach your goal.

Step 3 – Projected growth rate

In step 1 we looked at where you are right now financially and how much you intend to add each year. In step 2, we looked at where you ideally want to get to and by when. In this next step we’ll look at your expected projected growth rate. Most of the investors we speak to who are having trouble increasing their portfolios tell us that they have been growing their accounts at approximately 4–5% per year; our aims are higher than this.

We help some of our clients aim for 5–8% per year but the majority of them aim for 12–15% per year. On this site you'll find a compounding calculator tool that is very useful for this next exercise, but please feel free to use an alternative because the Internet has lots of free compounding calculators to choose from.

If you do want to look at the one we have, simply go to the top of this page and type in ‘plan’ as your username and ‘plan1234’ as your password. You’ll then get access to part of our members area which includes the use of our compounding calculator.

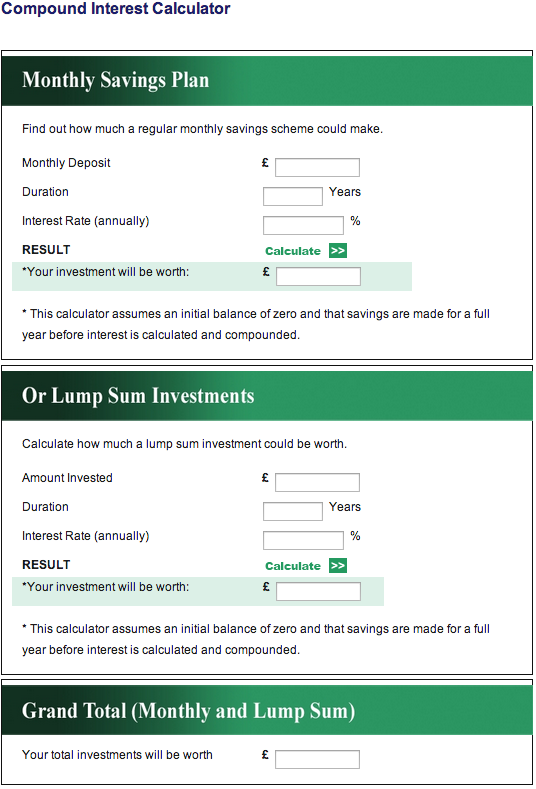

To access the calculator, go to the left hand column and click on the link that says ‘Compound Interest Calculator’. Before you tap any figures into the calculator, familiarise yourself with it. It is split into three sections. The top half of the calculator is called ‘Monthly Savings Plan’ and this is the part that we use to calculate how money grows when saved regularly and invested on a monthly basis. The second half of the calculator is for working out how lump sum investments grow over time at different rates of return and the bottom half of the calculator works out the total.

Let’s give you an example of how this works. Most of our clients are already affluent when they approach us. Almost all of them have over £100,000 actively invested and many are already millionaires in their own right. For this example then, we’ll imagine a client telling us they have a 7 year time frame and a starting amount of £500,000 which they plan to add £20,000 per year for the full duration of their plan. They also tell us that they are aiming for a £50,000 per year lifestyle with inflation factored in.

- 7 year time frame

- starting amount of £500,000

- plan to add £20,000 per year/£1,667 per month

- aiming for a £50,000 per year lifestyle with inflation factored in

If we go back to the inflation factoring table we looked at in our last post, the calculation over a 7 year period was 23% which means the client’s new annual income goal is £61,500 per year. To get to £61,500, I simply multiplied £50,000 by 23%. We also know that we use 5% as our withdrawal rule. To calculate the amount our client needs to aim for, we simply divide £61,500 by 5 and multiply it by 100. The result is £1.23 million.

- 7 year time frame

- starting amount £500,000

- plan to add £20,000 per year/£1,667 per month

- aiming for a £50,000 per year lifestyle with inflation factored in

- with inflation factored in, it’s £61,500 per year

- to withdraw 5% per year, our target amount is £1.23 million

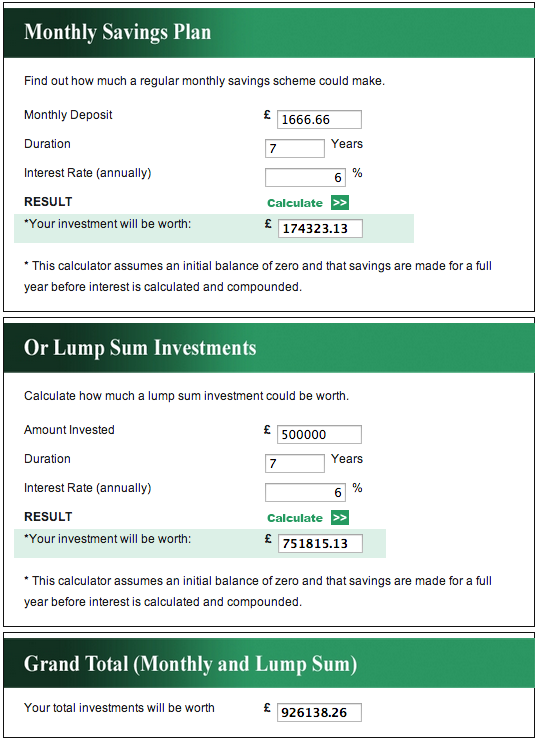

Now that we know where we are and where we are trying to get to, we can have a play on the calculator. We are going to start by using annual growth rates of 6%. In the top half, because we know our client wants to add £20,000 per year, we can divide £20,000 by 12 and get a figure of £1,666.66 which is the amount we can enter into the calculator for our monthly deposit.

In the duration field we can enter 7 which represents 7 years, and in the interest rate field we can enter 6 which represents a 6% annual return aim. In the second section of the calculator, the section where we enter the starting lump sum, we can enter £500,000 as the amount invested, 7 for the duration of 7 years and 6 for the annual rate of return aim. When we click on the two calculate buttons, the monthly savings plan of £20,000 per year at 6% annual return for 7 years results in £174,323. The lump sum of £500,000 at 6% annual return for 7 years results in £751,815.

The grand total is £926,138.

- saving £20,000 per year at a 6% annual return for 7 years = £174,323

- £500,000 at a 6% annual return for 7 years results in £751,815

- grand total is £926,138

If you remember, this client had a goal of £1.23 million which means they have a shortfall of just over £300,000. In a situation like this, the client has four options and in the final post of this series we'll explore them in more detail.

As always, if you have any questions or thoughts on the points covered in this post, please leave a comment below or connect with us @ISACO_ on Twitter.

About ISACO

ISACO is a specialist in ISA and SIPP Investment and the pioneer of ‘Shadow Investment’, a simple way to grow your ISA and SIPP. Together with our clients, we have £57 million actively invested in ISAs and pensions*.

Our personal investment service allows you to look over our shoulder and buy into exactly the same funds as we are buying. These are investment funds that we personally own and so you can be assured that they are good quality. We are proud to say that by ‘shadowing’ us, our clients have made an annual return of 12.5% per year over the last four years** versus the FTSE 100’s 7.4%.

We currently have close to 400 carefully selected clients. Most of them have over £100,000 actively invested and the majority are DIY investors such as business owners, self-employed professionals and corporate executives. We also have clients from the financial services sector such as IFAs, wealth managers and fund managers. ISACO Ltd is authorised and regulated by the Financial Conduct Authority (FCA). Our firm reference number is 525147.

* 15th November 2012: Internal estimation of total ISA and pension assets owned by ISACO Investment Team and ISACO premium clients.

** (31st December 2008 - 31st December 2012).

ISACO investment performance verified by Independent Executives Ltd.

To download our free report 'A Golden Opportunity' >>

To download our Shadow Investment brochure >>

To start your 14 day free 'no obligation' trial of Shadow Investment >>